BlueHammer85

Well-Known Member

- Joined

- 13 Oct 2010

- Messages

- 41,018

Ah ok, that make sense. Good luck with it all.

I pay £432

Company pays £777

Ah ok, that make sense. Good luck with it all.

I started this thread after watching a small time youtuber planning retirement with 150k in a pot. Early retirement as well. I thought this was bonkers, but apparently the average size of a pension pot for someone aged 45~55 is £137k.I doubt it chief, it is a Bourgeois thread :)

I'm mainly DB rather than DC but most won't show their hands so don't feel inferior. I certainly won't but it is an interesting thread and no offence to anyone contributing.

Almost exactly what I'm paying into mine. I've worked out I will add £187k to my pot over the next 10 years (assuming 6%) compound growth.I pay £432

Company pays £777

Haha.

I started this thread after watching a small time youtuber planning retirement with 150k in a pot. Early retirement as well. I thought this was bonkers, but apparently the average size of a pension pot for someone aged 45~55 is £137k.

Almost exactly what I'm paying into mine. I've worked out I will add £187k to my pot over the next 10 years (assuming 6%) compound growth.

Haha.

That’s the average for 55-64 according to Money Week. https://moneyweek.com/personal-finance/pensions/average-pension-pot-by-ageI started this thread after watching a small time youtuber planning retirement with 150k in a pot. Early retirement as well. I thought this was bonkers, but apparently the average size of a pension pot for someone aged 45~55 is £137k.

I use AJ Bell. Its easy enough to use and compares well on fees.Does anyone have any recommendations on what private pension company to go for. Bit of a minefield and hoping some recommendations may narrow down my search. Going self employed and have around 15 years of decent contributions to go.

Have a look at "Meaningful Money". He's an IF Planner who is highly regarded in the industry and put things across really simply.Does anyone have any recommendations on what private pension company to go for. Bit of a minefield and hoping some recommendations may narrow down my search. Going self employed and have around 15 years of decent contributions to go.

I'm very similar, all the males on both sides of my parent's families have been dead or dying by the age of 70, so even though I've got a reasonable pension provision I very much doubt I'll get to take full advantage of it.I'm like you (apart from being a bit older)

And my back of a fag packet calculations give me a draw down till my mid 80's

As a person whose mum passed at 60, Dad at 72 and the only grandparent I knew at 79, longevity isn't on my side

An IFA once told me only an idiot would risk surrendering or leaving either of them. They are a gold plated guarantee of security.I'm in the GMPF (council one)

Mrs has a Teachers pension

Both are meant to be really good, so people keep telling me. Haven't got a clue to be honest.

Yeah, I suppose it depends on what your lifestyle and overall spend is but I'd say £540k upwards would see me and many others more than happy, plus it depends on when you intend to retire. From 67 onwards - probably soon to be 68 - you also have the state pension to draw on too. As you say, you're more likely to spend more money in the early years of retirement as that's when you should be healthy enough to get out and about spending money.I love the way these publications come up with bonkers amounts you need for your retirement. It's no wonder it puts some people of bothering to save.

£540,000 to £800,000 anyone? I'm sure some people have done well and will hit this range but 've been fully employed since 22, on a decent wage and I'm just above £250K at age 57.

Like many I have had to "fritter" money away on bringing up a family and enjoying life (OK, I go on too many holidays) but you always have to make sure you spend enough to enjoy life with your family and whilst you are fit enough to enjoy the world.

Know next to zilch about pensions other than you will both be minted if you retire on these.I'm in the GMPF (council one)

Mrs has a Teachers pension

Both are meant to be really good, so people keep telling me. Haven't got a clue to be honest.

I would count any savings pots and private pensions together. I've got all mine in a pension but that's because I've worked since my early 20s in finance where a decent pension was part of the deal. But having it in a pension means 1 its tied up and I can't access it until I'm 57. And 2 it's all gone in tax free and I will have to pay tax when I draw it out.Yeah, I suppose it depends on what your lifestyle and overall spend is but I'd say £540k upwards would see me and many others more than happy, plus it depends on when you intend to retire. From 67 onwards - probably soon to be 68 - you also have the state pension to draw on too. As you say, you're more likely to spend more money in the early years of retirement as that's when you should be healthy enough to get out and about spending money.

I'm 2 years younger than you and nowhere near your £250k figure. Try just over £100k but I've currently got around £700k a month going in. I also have decent savings pot spread around ISAs - both cash and stocks and shares - and high interest savings accounts, and I'm putting around £500 a month into those. I estimate that in today's money I'd need around £30,000 a year (after tax) to keep doing the things I enjoy doing at the moment - holidays, doing all the home games and roughly around half the aways, nights out with mates, and meals out with the other half. That £30k figure assumes my mortgage will be paid off (otherwise it will be closer to £40,000 a year) which is currently years away from happening! But if it is, and my pension and ISAs/savings keep increasing at around 4%-5% a year on average then I may have enough to call it a day when I'm 62 or 63, given that it will only be another 5 years or so before I can also call on my state pension. The plan would be to access the savings and ISAs first (maybe someone with more knowledge will be along to tell me that's absolutely the wrong way to go about things!), allowing my private pension to potentially grow for a few more years before drawing on that.

Try just over £100k but I've currently got around £700k a month going in. I also have decent savings pot spread around ISAs - both cash and stocks and shares - and high interest savings accounts, and I'm putting around £500 a month into those.

Yeah, as you say it would be mad to pass up the opportunity of that 11% your employer puts in. I see any employer contribution as "free money". Mine isn't quite as generous - it's 3% on top of the 5% I put in which I think is the minimum employer requirement for a workplace pension but even so, 3% is better than nothingI would count any savings pots and private pensions together. I've got all mine in a pension but that's because I've worked since my early 20s in finance where a decent pension was part of the deal. But having it in a pension means 1 its tied up and I can't access it until I'm 57. And 2 it's all gone in tax free and I will have to pay tax when I draw it out.

My current job pays 11% in to my pension if I do 5%. So I've got 16% going in pre tax every month. It's over £1k a month. More than I need but I'd be crazy not to take it. And therefore I don't have much in savings outside of this.

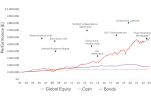

I totally agree. The only reason why I have some invested in cash at the moment is because of the interest that cash savings and ISA's are currently paying. Around 4% is far better than it was for years when interest rates were stuck at 0.5%. If the interest rate continues to fall as predicted then the cash option becomes less attractive and I'll move more over to stocks and shares. I'm looking at having mine invested for 5-7 years minimum so more medium term than long termGeneral view is that *if* your savings are for the long term you should avoid cash. Over time it's historically been very poor compared to stocks and shares

eg from RBS

View attachment 170274

£700K a month! Rich bastard :).... but I've currently got around £700k a month going in.

Did you tell that director that he's a cnut :)I’d be interested to see that vid!

I had the other end of the scale the other day in a conversation with a director at work, he wants to retire at 55 and had calculated he needed 9.6 million!