the blue panther

Well-Known Member

Fuckin' 'ell - I bet you're a scream at the literary luncheon.Needs a space between each one mate. Just makes it easier to read (for me and I know a few others have mentioned it on other people’s posts).

Fuckin' 'ell - I bet you're a scream at the literary luncheon.Needs a space between each one mate. Just makes it easier to read (for me and I know a few others have mentioned it on other people’s posts).

Everyone knew their place before city came along. City showed clubs that went below the radar and lost years competing due to bad ownership that one day you could rise again and achieve success. The league is all about the status quo.With the sheer irony being, that were not the club that need their spending curbed.

You could argue that the team with the highest level of debt, shouldn't also have the largest net spend to go alongside it.

United have been able to 'spend the money they're generating' and yet that money is somehow different to the money we've got from winning 7 of the last 8 league titles, as well as numerous domestic cups and the champions league.

Mad that clubs like West Ham think that City are the problem.

I think the Government are holding a big conference this week aimed at getting more foreign investment into the Country, because we as a Country need the investment.Could you imagine if this happened in any other businesses in this country there would be not many companies posting any profits

It doesn't sound like fair market value though, perhaps it needs looking into :)Fuck me they got a belting deal compared to ours

Surely fans of other clubs can see this?Everyone knew their place before city came along. City showed clubs that went below the radar and lost years competing due to bad ownership that one day you could rise again and achieve success. The league is all about the status quo.

1-4 Rags,Liverpool, arse, chavs/spurs

The rest make up mid table and relegation and sell their best players season after season. Now fans ask why do we have to sell? We want to compete and that means spending money they don’t want to spend.

We shook the foundations and as a result became the nemesis of any club who knew their place and didn’t need to worry about competing as long as the illusion of fair competition could be peddled to the mass football brain dead horde.

West ham know their place. As do Brighton, wolves, Brentford et al.

Mansour, Khaldoon, Txiki,Soriano and the main man Pep is what they were not prepared for. We gave the latter a blank canvas and his did the rest.

There are 13 clubs in the premier league with shareholder loans. Everton £451m, Brighton £373m, Arsenal £259m, Chelsea, Liverpool, Leicester, Bournemouth, Wolves, Brentford, Crystal Palace, Nottingham Forest, Aston Villa and Fulham.

The APT rules were declared unlawful as they did not include shareholder loans, which we all now know was by design when drafting the rules.

If, going forward, APT are to be part of the Premier league rules then shareholder loans is the one and only ruling that MUST form part of the APT legislation otherwise they will once again be ruled unlawful.

To that end, how many of the aforementioned clubs will vote for APT to be part of the the Premier League rule book knowing that they will have to include interest payments on shareholder loans as part of their PSR calculations.

Associated Party Transactions as an entity is no longer an option for the Premier League given that 14 of the 20 members have to vote in favour and in my opinion the cartel clubs will have to come up with something a little more intelligent than the previous APT rules which have been shown to be targeted towards the Gulf owners.

I’m surprised the media were so quick to support the Premier League’s stance that City were successful in a couple of minor points and that the rules would be reinstated quickly with a couple of tweaks.

Actually after all the shit that the media have thrown at us over the past decade I am not surprised they are not willing to see what’s in front of their faces.

The likes of Panja, Delaney etc are going to struggle to resurrect their careers when the truth eventually comes out. Cunts!

Football tribalism. Fans either don’t care as you said or are happy being lied to. We see it every day on the news. Football is no different to any other industry well maybe it is different in that we all love our clubs. So that emotional pull can lead to easy manipulation.Surely fans of other clubs can see this?

The tribal nature of football astounds me. HOWEVER, yesterday I rewound to 2006 & City going nowhere fast under Pearce, & if what was happening to City now was happening to the Rags then, how would I have reacted?

I'd know FFP, PSR & APT were bollocks, but because it was hampering ManUre, I probably wouldn't give a shit & be all for it.

A few of us rounded on the Geordie who posted over the weekend, but if we were one of the mid-table - relegation fodder also rans, would we be so understanding of a successful club under sustained UEFA & PL attack?

Many of us wouldn't be if we're being honest...

We tried to be respectful & gentlemanly about our ambitions, but it seems we're damned if we do & damned if we don't, so fuck the lot of em!Football tribalism. Fans either don’t care as you said or are happy being lied to. We see it every day on the news. Football is no different to any other industry well maybe it is different in that we all love our clubs. So that emotional pull can lead to easy manipulation.

City have ruined people’s lives by winning. That type of grudge could last forever. Especially if they have been told by the media and their own clubs that we ruined their lives by cheating then you see the emotionally charged reaction.

The PL forget and remember whatever they are told to forget or remember.

There not saying you have to alter the loans just alter how they are accounted for for PSR not even the normal accounts and I don’t see how it negatively affects the lender to get interest they would not have got they are not forcing anyone to take any loans

Pretty much. The club today is one of the best in the world. That’s a fact many don’t want to acknowledge.We tried to be respectful & gentlemanly about our ambitions, but it seems we're damned if we do & damned if we don't, so fuck the lot of em!

Can't stand K B but she did cracking deal for West Ham more fools the person or people who signed it of! Maybe she gave them something an envelope or an account in the Cayman islands! One thing that deal was unbelievable! Just think in another ten years it could cost the tax payer around 400/500m just think if someone from Saudi or Abu Dhabi owned West Ham and got that deal you'd never here the end of it

Interestingly, I worked out the other week that we repaid the loan to get the stadium ready for football (£22m) around about 2014Someone should ask her about this.

Overview of Financial Losses

The London Stadium, home to West Ham United, continues to represent a significant financial challenge for the capital’s taxpayers, as revealed in the latest accounts from the London Legacy Development Corporation (LLDC). Despite efforts to mitigate losses by hosting concerts and other events, the stadium’s owner, E20 Stadium LLP, reported a staggering loss of £20.9 million in the financial year ending May 31, 2024. According to The Times.

Costs Versus Income: An Imbalance

The financial report highlights the disparity between the costs of maintaining the stadium and the income generated. Notably, West Ham United pays a relatively modest rent of £3.6 million per season, which covers none of the stadium’s upkeep costs such as heating, cleaning, or maintenance. This situation is compounded by the fact that West Ham retains all ticket revenues and a portion of the catering income, further skewing the financial equation in favour of the club.

Report: West Ham’s £20.9m London Stadium Loss Hits Taxpayers Hard

Financial Strain at the London Stadium: A Closer LookOverview of Financial LossesThe London Stadium, home to West Ham United, continues to represent a significant financial challenge for the capital��...sports.yahoo.com

On top of.

London Mayor Sadiq Khan has ordered an investigation into the cost of converting the Olympic Stadium into West Ham's new home. The move comes as it was revealed the conversion costs have jumped by another £51m to £323m from £272m. Balfour Beatty was in charge of converting the stadium under a £190m contract.

Borsan said we had a marginal win, at least Jordan accepted we had a very good day in Court!Hang on, is this the same dude who claimed City lost the tribunal by TKO? \0/

Talk about going with which way the wind is blowing! As stated, I refuse to click on any link where this self styled 'City Insider' is regaling his bullshit pearls of wisdom.

What a difference a few days make hey?

There is clearly nothing illegal about soft loans, per se.

But here is a question. Is it actually legal to prevent an owner funding a company with soft loans? For example, directors of a company that owns a club have a Companies Act responsibility to act in the interest of the company's shareholders. There may be good reasons why the directors consider soft loans to be in the interests of the shareholders. Who are the PL to say they can't do that? Is it not abuse of a dominant position to force an owner to restructure its funding (that is what the current APT rules require), potentially unfavourably to the shareholders.

It's the same question as forcing a club to renegotiate downwards (or upwards!) a sponsorship contract which was accepted by both parties as being to the benefit of the shareholders.

Which responsibility takes precedence? The responsibility of the directors of the club, or of the club owners, to their shareholders, or the contractual responsibility set out in the PL rules?

Or maybe I am missing something simple. It wouldn't be the first time ......

If I Die .. I think you may have misunderstood my post. Of course loans will be recorded in the balance sheet as both an asset in the bank account and as a loan creditor. This is standard accounting practise for any loanActually is does matter whether interest is charged and applied to the profit and loss account which affects the bottom line. It also matters that any loans need to be disclosed in the balance sheet as a creditor thus affecting the financial strength of a business/organisation. However I do agree with your main point on financial doping

The big problem for the Premier league was City were given tge best oart of fuck all information on tge process and the result of the process - basically "The red cartel says no."If I Die .. I think you may have misunderstood my post. Of course loans will be recorded in the balance sheet as both an asset in the bank account and as a loan creditor. This is standard accounting practise for any loan

However it is believed that a number of clubs including Arsenal, Liverpool, Brighton et al have received soft loans from related parties/shareholders. These loans and agreements backing the loans have been made at 0% or as near to as makes little or no difference. If the loan agreement is for 0% interest then there is no requirement for the club/entity to declare an interest charge in its P&L account or a liability in the balance sheet as there is no liability to pay any interest. This should be straight forward as far as statutory accounts are concerned.

What the tribunal have ruled is that these zero interest loans from 'related parties' should be treated as arms length or FMV loans in the same way that sponsorship deals from 'related parties' are required to be at fair market value, but only for PSR calculation purposes. The PL has no authority to tell clubs what interest they should actually in fact pay their lender, that would be absurd. Such loans on the open market would typically, currently, accrue interest at a rate of around 8% to 10% per annum.

The 'soft loans' help reduce costs for the recipient by keeping interest charges out of the P&L account, and the statutory accounts but NOT now for PSR calculations.

By the same token the current PL FMV assessments for alleged related party income sponsorships allegedly aim to ensure that income received by the beneficiary is not artificially inflated above the market value of comparable deals - who decides this and how is another matter altogether - available on the open market.

In summary, the tribunal have essentially ruled that 'artificially' reduced loan costs from related parties must now come under the same umbrella as 'artificially' inflated related party sponsorships and disallowed for PSR purposes or as some might see it they are two cheeks of the same arse.

If I Die .. I think you may have misunderstood my post. Of course loans will be recorded in the balance sheet as both an asset in the bank account and as a loan creditor. This is standard accounting practise for any loan

However it is believed that a number of clubs including Arsenal, Liverpool, Brighton et al have received soft loans from related parties/shareholders. These loans and agreements backing the loans have been made at 0% or as near to as makes little or no difference. If the loan agreement is for 0% interest then there is no requirement for the club/entity to declare an interest charge in its P&L account or a liability in the balance sheet as there is no liability to pay any interest. This should be straight forward as far as statutory accounts are concerned.

What the tribunal have ruled is that these zero interest loans from 'related parties' should be treated as arms length or FMV loans in the same way that sponsorship deals from 'related parties' are required to be at fair market value, but only for PSR calculation purposes. The PL has no authority to tell clubs what interest they should actually in fact pay their lender, that would be absurd. Such loans on the open market would typically, currently, accrue interest at a rate of around 8% to 10% per annum.

The 'soft loans' help reduce costs for the recipient by keeping interest charges out of the P&L account, and the statutory accounts but NOT now for PSR calculations.

By the same token the current PL FMV assessments for alleged related party income sponsorships allegedly aim to ensure that income received by the beneficiary is not artificially inflated above the market value of comparable deals - who decides this and how is another matter altogether - available on the open market.

In summary, the tribunal have essentially ruled that 'artificially' reduced loan costs from related parties must now come under the same umbrella as 'artificially' inflated related party sponsorships and disallowed for PSR purposes or as some might see it they are two cheeks of the same arse.

Thanks. Let me test you on whether the APT rules don't exist. City told the other clubs that the rules were null and void.

No-one seemed to have explained why that was so (in public) but it seems clear from s.2 of the Competition Act.

Agreements etc. preventing, restricting or distorting competition.

(1) Subject to section 3, agreements between undertakings, decisions by associations of undertakings or concerted practices which—

(a) may affect trade within the United Kingdom, and

(b) have as their object or effect the prevention, restriction or distortion of competition within the United Kingdom,

are prohibited unless they are exempt in accordance with the provisions of this Part.

(2) Subsection (1) applies, in particular, to agreements, decisions or practices which—

(a) directly or indirectly fix purchase or selling prices or any other trading conditions;

(b) limit or control production, markets, technical development or investment;

(c) share markets or sources of supply;

(d) apply dissimilar conditions to equivalent transactions with other trading parties, thereby placing them at a competitive disadvantage;

(e) make the conclusion of contracts subject to acceptance by the other parties of supplementary obligations which, by their nature or according to commercial usage, have no connection with the subject of such contracts.

(3) Subsection (1) applies only if the agreement, decision or practice is, or is intended to be, implemented in the United Kingdom.

(4) Any agreement or decision which is prohibited by subsection (1) is void.

Start at the end. What is void? The decision of the PL to introduce APT rules - because the rules were judged unlawful under s.2(1) - some of s.2(2) may apply - and are therefore prohibited under s.2(1) and the decision is therefore void under s.2(4).

Happy to learn if that interpretation is wrong. (Well, not happy.)

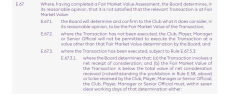

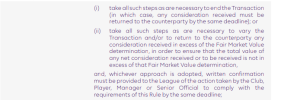

I think you have also misunderstood the current APT rules. Contracts have to be re-written to fmv, it's not just a question of adjusting the PL impact for PSR:

View attachment 134891

View attachment 134892

Which, again, is my question. What legal right does the PL have to impose that on a company not subject to the PL rules or, for that matter, even a company that is subject to the PL rules.