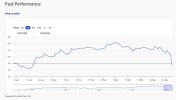

The problem is, it's not is it.

Shares keep on going down.

They will go down on Monday when the markets open again.

Nobody knows if and when Trump is going to put a stop to this.

This could go on for weeks, months, even years until Trump finally gets what he wants or when he is out of office.

There is absolutely no indication Trump is going to end his personal trade war against the world.

In fact, he might increase trade tariffs on countries and on continents that have put new trade tariffs on America.

You can buy shares next week, but in the coming weeks and months they could be worth half or less than what you paid for them, thinking it was the right time to buy.

- Jaguar Land Rover has today said it will "pause" shipments to the US this month, as it considers how to address "the new trading terms" of Trump's tariffs.

View attachment 152066

Anti-Trump demonstrators gather in Asheville, North Carolina

Donald Trump imposed a 25% tariff on foreign-made cars as part of his economic plan to "supercharge" the US economy.

www.bbc.co.uk