Great post, wish I could understand all the implications, my lack of knowledge not yours obviously.The jobs report saw a jump in unemployment, which has been inching up from record lows. The reason? The Fed is keeping interest rates high to try to FORCE LAYOFFS AND COOL INFLATION.

Inflation has been slowly retreating, but has remained stubborn at around 3%, Vice the Fed’s 2% target rate. They’ve made clear they are not going to wait until it gets to 2%, but they want to see it continuing towards that level. Wages have been fueling consumer demand, but Q2 results of consumer discretionary companies have shown that is weaker than expected.

So, as the consumer slows down, company results are down, which is helping inflation slow, as job losses increase.

NORMALLY, all of these things would signal we are on the verge of a recession, but these are all currently being manipulated by Fed Policy.

However, the fear is that, much as the Fed was late to raise rates quickly when post-COVID inflation rose dramatically, so they will be too slow to lower rates (fearing an uptick in business activity and thus a resultant uptick in inflation!).

In Japan, where people borrow at 0% to invest in the booming US equity market, the interest rate was suddenly raised about 25 basis points for the first time in almost two decades. That led to a mass panic in Japan and left Japanese arbitrage investors looking for the exit…and the massive selloff began!

It reverberated around the world, mainly because they invest so much in high tech US stocks, many of which had a “meh” second quarter, yet said 2024 would still be a good year and 2025-26 would be gangbusters, due to lower rates (that aren’t here yet!).

The U.S., which is still up handsomely for the YTD is entering a seasonal soft period (Sept) where stocks often pause or retrench, so this whole series of events looks like an early continuation of the pullback in U.S. equities, albeit in a short, sharp reflexive drop.

Normally, the U.S. equity day is a 3 step process…

1) The open, which is based on the events of the global day, which has already occurred in Asia and is in full swing in Europe

2) The midday period, which watches how Europe settles out and how European late day trading sets up for the next trading day

3) The afternoon and close, with the last hour of trading creating the investment psyche and impetus for the next global trading day in Asia

Currently, the Mag 7 are still driving the market, both up and down, but there is so much money chasing those gains (and passive funds and even large ETFs needing to take massive positions in them) that they have become ATMs. If you want money out of the market, you sell the gains in some of these high tech high flyers! In short, they trade for reasons other than fundamentals and can thus be whipsawed by the desire to take profits or liquidate large positions to access cash.

I personally have large stakes in numerous of these companies and have watched them be whipsawed intra-day/week/month/year, yet their lower left-upper right trajectory has remained intact.

Getting back to the Fed, there may be a strong case now for them to cut rates by 25 basis points BETWEEN MEETINGS, which is a tad rare, to stop any anxiety from creating the self-fulfilling prophecy of high rates and external influences driving the US towards a recession, then adding another, already anticipated, 25 basis point cut in September at their meeting.

Many observers are concerned that the Fed isn’t nearly as nimble as they should be, and often close the barn door after the horse has bolted. They believe the loooong period of high interest rates has actually damaged some underlying economic engines that need reigniting before the lagging effects take hold.

The quandary is that small interest rate HIKES are slow to impact the economy, as no-one knows how high they might go and the incremental change can often be manageable in the strong economy that creates the hikes, whereas interest rate CUTS are often taken as a signal that rates are going to continue to decrease.

In a 9-12 month forward looking company/equity market, the presuppositions that 25 becomes 50 becomes 75 becomes 100, and equities often take off as economic activity begins to pick up again.

So, what does all this mean?

The US has been looking for an excuse to have a brief, possibly even sharp, correction in the MAG 7 stocks that have driven the market to record highs. That correction was happening over the course of the Q2 results reporting season, with one company in a sector often creating the downdraft (or updraft) for that sector.

Last week, Amazon created a downdraft. The BoJ just created another, much more significant, one based on the Japanese money in US tech. That caused a big wave to wash around the globe as markets opened in the Asia, the ME, Europe and the U.S.

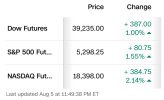

At one point last night when I was watching, US futures were down over 1,000 points. However, from the open in the U.S., traders saw that as the opening they need to deploy capital.

As that washed through the market during the European close, equities were much improved from the open, albeit still down 2-3%.

Now, as we approach the close, we see Wall Street starting to position for what they thing the rest of the world is going to do to the markets overnight, and the steady decline during the afternoon session has barely caught a bid. That means Asia will open to reflect the bad sentiment in the U.S. post-European close (albeit with the chance that Japanese policy confuses and possibly exaggerates things), and the cycle will begin again for Tuesday in the U.S.

History shows that many, many times these events are short, sharp and even violent, but the opportunity to get out and back in BEFORE the POTENTIAL violent upswing is fleeting and a fool’s errand!

I believe AMZN, GOOG, and META, will all be much higher in 3-5 yrs than they are today and were last week. That’s why I haven’t touched a penny of their value this past week.

That said, I’m getting ready to put money I’ve been holding for a period just like this one to work!

Never a dull moment!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

One Fan Clapping

Well-Known Member

Japan rebounds back 9%.

Serious money made over 48 hours.

Mad times.

Serious money made over 48 hours.

Mad times.

Last edited:

ChicagoBlue

Well-Known Member

- Joined

- 10 Jan 2009

- Messages

- 21,999

Gareth Barry Conlon

Well-Known Member

- Joined

- 5 Sep 2014

- Messages

- 15,959

I still think a correction was due and is due. Some crazy prices.Was a reflexive action, with a reflexive reaction, resulting in a far more reasonable two-day decline.

Now, let’s watch to see if the wave rolls around the world…so far it is…

View attachment 127498

When the fed cuts will be very interesting. They should cut now, they instinctively might want to hold but they also will want to avoid the election run in as they don't want to be seen as political. Arguably they missed to boat and it is pretty close now. But still doing it sooner than later helps on that front. Obviously politics should have no bearing but the fear of being seen as taking a politicised decision tends to grip people into inaction.

dickie davies

Well-Known Member

Everything is taking a hammering

I was reading an article over the weekend that said, after the USA's Labor Day, history says that September is a historically bad month

www.standard.co.uk

www.standard.co.uk

I was reading an article over the weekend that said, after the USA's Labor Day, history says that September is a historically bad month

FTSE 100 Live: Index under pressure after US sell-off, Barratt posts results

Last edited:

Kompany Car

Well-Known Member

- Joined

- 19 Sep 2015

- Messages

- 4,270

Trying to time the market is nigh on impossible. I've seen and talked to enough people to know that investors who leave their money in the markets almost always have a better outcome in the medium to long term than those who try to time the peaks and reinvest in the troughs.The jobs report saw a jump in unemployment, which has been inching up from record lows. The reason? The Fed is keeping interest rates high to try to FORCE LAYOFFS AND COOL INFLATION.

Inflation has been slowly retreating, but has remained stubborn at around 3%, Vice the Fed’s 2% target rate. They’ve made clear they are not going to wait until it gets to 2%, but they want to see it continuing towards that level. Wages have been fueling consumer demand, but Q2 results of consumer discretionary companies have shown that is weaker than expected.

So, as the consumer slows down, company results are down, which is helping inflation slow, as job losses increase.

NORMALLY, all of these things would signal we are on the verge of a recession, but these are all currently being manipulated by Fed Policy.

However, the fear is that, much as the Fed was late to raise rates quickly when post-COVID inflation rose dramatically, so they will be too slow to lower rates (fearing an uptick in business activity and thus a resultant uptick in inflation!).

In Japan, where people borrow at 0% to invest in the booming US equity market, the interest rate was suddenly raised about 25 basis points for the first time in almost two decades. That led to a mass panic in Japan and left Japanese arbitrage investors looking for the exit…and the massive selloff began!

It reverberated around the world, mainly because they invest so much in high tech US stocks, many of which had a “meh” second quarter, yet said 2024 would still be a good year and 2025-26 would be gangbusters, due to lower rates (that aren’t here yet!).

The U.S., which is still up handsomely for the YTD is entering a seasonal soft period (Sept) where stocks often pause or retrench, so this whole series of events looks like an early continuation of the pullback in U.S. equities, albeit in a short, sharp reflexive drop.

Normally, the U.S. equity day is a 3 step process…

1) The open, which is based on the events of the global day, which has already occurred in Asia and is in full swing in Europe

2) The midday period, which watches how Europe settles out and how European late day trading sets up for the next trading day

3) The afternoon and close, with the last hour of trading creating the investment psyche and impetus for the next global trading day in Asia

Currently, the Mag 7 are still driving the market, both up and down, but there is so much money chasing those gains (and passive funds and even large ETFs needing to take massive positions in them) that they have become ATMs. If you want money out of the market, you sell the gains in some of these high tech high flyers! In short, they trade for reasons other than fundamentals and can thus be whipsawed by the desire to take profits or liquidate large positions to access cash.

I personally have large stakes in numerous of these companies and have watched them be whipsawed intra-day/week/month/year, yet their lower left-upper right trajectory has remained intact.

Getting back to the Fed, there may be a strong case now for them to cut rates by 25 basis points BETWEEN MEETINGS, which is a tad rare, to stop any anxiety from creating the self-fulfilling prophecy of high rates and external influences driving the US towards a recession, then adding another, already anticipated, 25 basis point cut in September at their meeting.

Many observers are concerned that the Fed isn’t nearly as nimble as they should be, and often close the barn door after the horse has bolted. They believe the loooong period of high interest rates has actually damaged some underlying economic engines that need reigniting before the lagging effects take hold.

The quandary is that small interest rate HIKES are slow to impact the economy, as no-one knows how high they might go and the incremental change can often be manageable in the strong economy that creates the hikes, whereas interest rate CUTS are often taken as a signal that rates are going to continue to decrease.

In a 9-12 month forward looking company/equity market, the presuppositions that 25 becomes 50 becomes 75 becomes 100, and equities often take off as economic activity begins to pick up again.

So, what does all this mean?

The US has been looking for an excuse to have a brief, possibly even sharp, correction in the MAG 7 stocks that have driven the market to record highs. That correction was happening over the course of the Q2 results reporting season, with one company in a sector often creating the downdraft (or updraft) for that sector.

Last week, Amazon created a downdraft. The BoJ just created another, much more significant, one based on the Japanese money in US tech. That caused a big wave to wash around the globe as markets opened in the Asia, the ME, Europe and the U.S.

At one point last night when I was watching, US futures were down over 1,000 points. However, from the open in the U.S., traders saw that as the opening they need to deploy capital.

As that washed through the market during the European close, equities were much improved from the open, albeit still down 2-3%.

Now, as we approach the close, we see Wall Street starting to position for what they thing the rest of the world is going to do to the markets overnight, and the steady decline during the afternoon session has barely caught a bid. That means Asia will open to reflect the bad sentiment in the U.S. post-European close (albeit with the chance that Japanese policy confuses and possibly exaggerates things), and the cycle will begin again for Tuesday in the U.S.

History shows that many, many times these events are short, sharp and even violent, but the opportunity to get out and back in BEFORE the POTENTIAL violent upswing is fleeting and a fool’s errand!

I believe AMZN, GOOG, and META, will all be much higher in 3-5 yrs than they are today and were last week. That’s why I haven’t touched a penny of their value this past week.

That said, I’m getting ready to put money I’ve been holding for a period just like this one to work!

Never a dull moment!

Im just treating it as being able to buy at a discount, but have not even once considered selling.

DenisLawBackHeel74

Well-Known Member

- Joined

- 20 Feb 2010

- Messages

- 12,894

Excellent post. Thank you. Agree in regards to buying opportunity…The jobs report saw a jump in unemployment, which has been inching up from record lows. The reason? The Fed is keeping interest rates high to try to FORCE LAYOFFS AND COOL INFLATION.

Inflation has been slowly retreating, but has remained stubborn at around 3%, Vice the Fed’s 2% target rate. They’ve made clear they are not going to wait until it gets to 2%, but they want to see it continuing towards that level. Wages have been fueling consumer demand, but Q2 results of consumer discretionary companies have shown that is weaker than expected.

So, as the consumer slows down, company results are down, which is helping inflation slow, as job losses increase.

NORMALLY, all of these things would signal we are on the verge of a recession, but these are all currently being manipulated by Fed Policy.

However, the fear is that, much as the Fed was late to raise rates quickly when post-COVID inflation rose dramatically, so they will be too slow to lower rates (fearing an uptick in business activity and thus a resultant uptick in inflation!).

In Japan, where people borrow at 0% to invest in the booming US equity market, the interest rate was suddenly raised about 25 basis points for the first time in almost two decades. That led to a mass panic in Japan and left Japanese arbitrage investors looking for the exit…and the massive selloff began!

It reverberated around the world, mainly because they invest so much in high tech US stocks, many of which had a “meh” second quarter, yet said 2024 would still be a good year and 2025-26 would be gangbusters, due to lower rates (that aren’t here yet!).

The U.S., which is still up handsomely for the YTD is entering a seasonal soft period (Sept) where stocks often pause or retrench, so this whole series of events looks like an early continuation of the pullback in U.S. equities, albeit in a short, sharp reflexive drop.

Normally, the U.S. equity day is a 3 step process…

1) The open, which is based on the events of the global day, which has already occurred in Asia and is in full swing in Europe

2) The midday period, which watches how Europe settles out and how European late day trading sets up for the next trading day

3) The afternoon and close, with the last hour of trading creating the investment psyche and impetus for the next global trading day in Asia

Currently, the Mag 7 are still driving the market, both up and down, but there is so much money chasing those gains (and passive funds and even large ETFs needing to take massive positions in them) that they have become ATMs. If you want money out of the market, you sell the gains in some of these high tech high flyers! In short, they trade for reasons other than fundamentals and can thus be whipsawed by the desire to take profits or liquidate large positions to access cash.

I personally have large stakes in numerous of these companies and have watched them be whipsawed intra-day/week/month/year, yet their lower left-upper right trajectory has remained intact.

Getting back to the Fed, there may be a strong case now for them to cut rates by 25 basis points BETWEEN MEETINGS, which is a tad rare, to stop any anxiety from creating the self-fulfilling prophecy of high rates and external influences driving the US towards a recession, then adding another, already anticipated, 25 basis point cut in September at their meeting.

Many observers are concerned that the Fed isn’t nearly as nimble as they should be, and often close the barn door after the horse has bolted. They believe the loooong period of high interest rates has actually damaged some underlying economic engines that need reigniting before the lagging effects take hold.

The quandary is that small interest rate HIKES are slow to impact the economy, as no-one knows how high they might go and the incremental change can often be manageable in the strong economy that creates the hikes, whereas interest rate CUTS are often taken as a signal that rates are going to continue to decrease.

In a 9-12 month forward looking company/equity market, the presuppositions that 25 becomes 50 becomes 75 becomes 100, and equities often take off as economic activity begins to pick up again.

So, what does all this mean?

The US has been looking for an excuse to have a brief, possibly even sharp, correction in the MAG 7 stocks that have driven the market to record highs. That correction was happening over the course of the Q2 results reporting season, with one company in a sector often creating the downdraft (or updraft) for that sector.

Last week, Amazon created a downdraft. The BoJ just created another, much more significant, one based on the Japanese money in US tech. That caused a big wave to wash around the globe as markets opened in the Asia, the ME, Europe and the U.S.

At one point last night when I was watching, US futures were down over 1,000 points. However, from the open in the U.S., traders saw that as the opening they need to deploy capital.

As that washed through the market during the European close, equities were much improved from the open, albeit still down 2-3%.

Now, as we approach the close, we see Wall Street starting to position for what they thing the rest of the world is going to do to the markets overnight, and the steady decline during the afternoon session has barely caught a bid. That means Asia will open to reflect the bad sentiment in the U.S. post-European close (albeit with the chance that Japanese policy confuses and possibly exaggerates things), and the cycle will begin again for Tuesday in the U.S.

History shows that many, many times these events are short, sharp and even violent, but the opportunity to get out and back in BEFORE the POTENTIAL violent upswing is fleeting and a fool’s errand!

I believe AMZN, GOOG, and META, will all be much higher in 3-5 yrs than they are today and were last week. That’s why I haven’t touched a penny of their value this past week.

That said, I’m getting ready to put money I’ve been holding for a period just like this one to work!

Never a dull moment!

ChicagoBlue

Well-Known Member

- Joined

- 10 Jan 2009

- Messages

- 21,999

Like you, I try to be a long term investor, although Boeing is testing my patience!!Trying to time the market is nigh on impossible. I've seen and talked to enough people to know that investors who leave their money in the markets almost always have a better outcome in the medium to long term than those who try to time the peaks and reinvest in the troughs.

Im just treating it as being able to buy at a discount, but have not even once considered selling.

Rebalancing is important, especially after some of the outsized gains in certain stocks can unbalance your diversification. With my regular monthly investment, I try to help that rebalancing as I go, but sometimes, an outsized gain or loss cannot easily be leveled out!

I have a wealthy friend who believes in what’s called a Permanent Portfolio. He usually balances every April Fool’s Day (He’s ironic in that he thinks anyone not doing it his way is a fool!) but rebalanced a little early this year because his Gold holdings were up 38% and were too heavily weighted.

I use a similar approach, albeit I keep a sizable chunk of money in a handful of individual long term holdings and then use a PP for the other 60-65%. In effect, I’m trying to get more juice from the squeeze, as I believe the stocks I hold are strong long term holdings, even though many of them are also upto 8% of some of the ETFs I hold.

In the interests of full disclosure, here you go…

(the ARKK & BRKB are in different investment accounts, which is why they’re separate at the bottom)

To each their own.

Kompany Car

Well-Known Member

- Joined

- 19 Sep 2015

- Messages

- 4,270

Dont disagree, I was, until a year back quite tech heavy but decided to buy more in the finance sector to rebalance things. To be fair most of it is in ETFs so the rebalancing to some extent takes care of itself but I try to look at the distribution and weightings in different sectors when I buy into funds to make sure its reasonably diversified and im not exposed to one area of the market.Like you, I try to be a long term investor, although Boeing is testing my patience!!

Rebalancing is important, especially after some of the outsized gains in certain stocks can unbalance your diversification. With my regular monthly investment, I try to help that rebalancing as I go, but sometimes, an outsized gain or loss cannot easily be leveled out!

I have a wealthy friend who believes in what’s called a Permanent Portfolio. He usually balances every April Fool’s Day (He’s ironic in that he thinks anyone not doing it his way is a fool!) but rebalanced a little early this year because his Gold holdings were up 38% and were too heavily weighted.

I use a similar approach, albeit I keep a sizable chunk of money in a handful of individual long term holdings and then use a PP for the other 60-65%. In effect, I’m trying to get more juice from the squeeze, as I believe the stocks I hold are strong long term holdings, even though many of them are also upto 8% of some of the ETFs I hold.

In the interests of full disclosure, here you go…

(the ARKK & BRKB are in different investment accounts, which is why they’re separate at the bottom)

View attachment 130825View attachment 130826

To each their own.

ChicagoBlue

Well-Known Member

- Joined

- 10 Jan 2009

- Messages

- 21,999

With interest rates coming down, the finance sectors looks like it could have a decent little run. That said, should the soft landing be a little harder, they may feel the economic pinch like everything else.Dont disagree, I was, until a year back quite tech heavy but decided to buy more in the finance sector to rebalance things. To be fair most of it is in ETFs so the rebalancing to some extent takes care of itself but I try to look at the distribution and weightings in different sectors when I buy into funds to make sure its reasonably diversified and im not exposed to one area of the market.

Had I taken that pic a month or so ago, you would have seen JPM as a holding, but I sold it after a nice little run up. Alas, Boeing has leveled out that…and then some! Their defence business is worth about what its trading for now, but their debt and coming cash flow problems (giving the slower pace of 787 & Max deliveries, coupled with the StarLiner black eye) are a concern.

Basically, you’re getting the airline division for free at $140, but let’s hope we don’t see that!!!

;-)

I'm no cynic but...

Well-Known Member

- Joined

- 22 Jan 2013

- Messages

- 4,000

- Location

- True friends stab you in the front.

- Team supported

- The one and only City

This is only a general observation of how markets work, but supply and demand is the controlling force behind market fluctuations.

A long time ago I was stuck behind a screen watching these fluctuations and trying to assess whether any move was a sign of things to come or whether these fluctuations were just random noise. A few I got right but many others I got wrong.

I still got out ahead, well ahead, but for the effort involved I may as well have just stuck it all away in a bank account and reinvested the interest. I didn't but when the banking crisis hit home, interest became very minimal and so I reassessed my position and instead of going for individual stocks I just invested in a few ETFs with the occasional investment that might have risen more slowly than the others in my portfolio.

The logic that I used was simply market forces that were evident through life itself. By this I mean the incessant rise in world population and the reduction in the availability of land to both house and feed this population.

The only way to see how the world is shaping up to this from an investment view is to watch how commodities and those things necessary to life are affected by these global forces. Shortages of those things of necessity will mean higher prices as demand will exceed supply.

Some will profit from it but I from my own point of view I feel rather uncomfortable with it and, as an aging person I've gone as far as I can. I just hope that you younger folk can profit from what may be lying ahead because for the many who do not realise it or do not care about it, life is going to become very difficult.

Take care folks.

A long time ago I was stuck behind a screen watching these fluctuations and trying to assess whether any move was a sign of things to come or whether these fluctuations were just random noise. A few I got right but many others I got wrong.

I still got out ahead, well ahead, but for the effort involved I may as well have just stuck it all away in a bank account and reinvested the interest. I didn't but when the banking crisis hit home, interest became very minimal and so I reassessed my position and instead of going for individual stocks I just invested in a few ETFs with the occasional investment that might have risen more slowly than the others in my portfolio.

The logic that I used was simply market forces that were evident through life itself. By this I mean the incessant rise in world population and the reduction in the availability of land to both house and feed this population.

The only way to see how the world is shaping up to this from an investment view is to watch how commodities and those things necessary to life are affected by these global forces. Shortages of those things of necessity will mean higher prices as demand will exceed supply.

Some will profit from it but I from my own point of view I feel rather uncomfortable with it and, as an aging person I've gone as far as I can. I just hope that you younger folk can profit from what may be lying ahead because for the many who do not realise it or do not care about it, life is going to become very difficult.

Take care folks.

I have a sum i would like to invest mate,could you explain what ETFs are and how they work,thanks in advanceThis is only a general observation of how markets work, but supply and demand is the controlling force behind market fluctuations.

A long time ago I was stuck behind a screen watching these fluctuations and trying to assess whether any move was a sign of things to come or whether these fluctuations were just random noise. A few I got right but many others I got wrong.

I still got out ahead, well ahead, but for the effort involved I may as well have just stuck it all away in a bank account and reinvested the interest. I didn't but when the banking crisis hit home, interest became very minimal and so I reassessed my position and instead of going for individual stocks I just invested in a few ETFs with the occasional investment that might have risen more slowly than the others in my portfolio.

The logic that I used was simply market forces that were evident through life itself. By this I mean the incessant rise in world population and the reduction in the availability of land to both house and feed this population.

The only way to see how the world is shaping up to this from an investment view is to watch how commodities and those things necessary to life are affected by these global forces. Shortages of those things of necessity will mean higher prices as demand will exceed supply.

Some will profit from it but I from my own point of view I feel rather uncomfortable with it and, as an aging person I've gone as far as I can. I just hope that you younger folk can profit from what may be lying ahead because for the many who do not realise it or do not care about it, life is going to become very difficult.

Take care folks.

I have a sum i would like to invest mate,could you explain what ETFs are and how they work,thanks in advance

I don't know what he's doing with his life now, but this is something I'd probably ask @SWP's back. He used to work in that sector.

SWP's back

Well-Known Member

- Joined

- 29 Jun 2009

- Messages

- 90,597

Exchange Traded Funds mate. Basically you pick an index (FTSE 100 or S&P500 etc), invest your money and it’s a very low cost (in terms of management change) way of investing in an index as a whole.I have a sum i would like to invest mate,could you explain what ETFs are and how they work,thanks in advance

So £100k in the FTSE100 would mean your money is invested in the 100 largest companies (based on market capitalisation) traded on the U.K. stock exchange.

Pros: low cost, investing in a large number of companies (depending on the index).

Cons: usually end up 100% equity based (rather than having some less volatile assets such as fixed income/government bonds etc) and can be very volatile.

Can’t go wrong with them if you invest and hold for ten years plus really although that’s easier said than done if the market drops 35% in six months.

As always, seek good independent advice before doing anything and the above isn’t that.

ChicagoBlue

Well-Known Member

- Joined

- 10 Jan 2009

- Messages

- 21,999

ETFs don’t ONLY track large indices. They can be used for sectors, such as finance, energy, healthcare, semiconductors, etc…, if you have a particular interest or desire to invest in those at any particular time.I have a sum i would like to invest mate,could you explain what ETFs are and how they work,thanks in advance

However, that also carries a little extra risk, as it’s not nearly as diversified as a market index, merely “diversifying” your money across the entire sector rather than one stock in that sector.

One can use a number of ETFs to broadly diversify one’s portfolio, while also adding other sector ETFs that might focus on something you feel might be a more timely investment.

In short, they can be viewed as mutual funds that can be traded like stocks, with you able to buy and sell them any time the market is open, as opposed to at the end of the market day.

For more info from my brokerage:

Last edited:

Cheers that's giving me plenty to chew on before any decisions are madeETFs don’t ONLY track large indices. They can be used for sectors, such as finance, energy, healthcare, semiconductors, etc…, if you have a particular interest or desire to

Invest in those at any particular time. However, that also carries a little extra risk, as it’s not nearly as diversified as a market index, merely “diversifying” your money across the entire sector rather that one stock in that sector.

One can use a number of ETFs to broadly diversify one’s portfolio, while also adding other sector ETFs that might focus on something you feel might be a more timely investment.

In short, they can be viewed as mutual funds that can be traded like stocks, with you able to buy and sell them any time the market is open, as opposed to at the end of the market day.

For more info from my brokerage:

I'm no cynic but...

Well-Known Member

- Joined

- 22 Jan 2013

- Messages

- 4,000

- Location

- True friends stab you in the front.

- Team supported

- The one and only City

You've had a good response to your ETF question and they are all relevant. The only thing I can add to this is an explanation of why management charges are lower with ETFs than with other fund management charges, that being is that ETFs are computer managed and do not add or delete components of the tracked index. The whole exercise behind ETFs is track the index without human interference and for this reason there is no manager to take his slice of any gains. The onus is at the door of the investor who will buy or sell as he or she wishes. Another reason to be happy about is that you get a consistent strategy without a manager getting sacked for poor results, something that happens all to frequently. You may be in a managed fund but in receipt of a letter which says that the fund is seeking a change of strategy from one that is outdated. Codeword for the fund is losing out to rival fund companies and losing investors, something that happens all too often.Cheers that's giving me plenty to chew on before any decisions are made

M18CTID

Well-Known Member

I see NIO is starting to recover a fair bit. About time too as I'm balls deep and currently massively in the red. Long-term predictions for the stock are good following a positive second-quarter earnings report last week. Deliveries of new vehicles hit a new high and the loss per share was better than expected. On the flip side, it's expected that costs will go up next year with a roll-out of more service centres, delivery hubs, and battery-swap stations.

The Black Shed

Well-Known Member

- Joined

- 9 Oct 2012

- Messages

- 4,262

Any rumours time wise for rolling out in the UK? That ES8 looks lovely and I'd definitely consider it against an Kia EV9.I see NIO is starting to recover a fair bit. About time too as I'm balls deep and currently massively in the red. Long-term predictions for the stock are good following a positive second-quarter earnings report last week. Deliveries of new vehicles hit a new high and the loss per share was better than expected. On the flip side, it's expected that costs will go up next year with a roll-out of more service centres, delivery hubs, and battery-swap stations.

M18CTID

Well-Known Member

Looking like sometime next year according to this: https://www.electrifying.com/blog/article/nio-to-launch-three-brands-in-uk-from-2025Any rumours time wise for rolling out in the UK? That ES8 looks lovely and I'd definitely consider it against an Kia EV9.

I’m not sure the model you’re looking at will be part of the initial roll out though, and it seems there are issues around where to locate the battery-swap stations so still some hurdles to overcome. For me, the battery-swap stations are a huge game-changer when it comes to EVs. 3 minutes to change a battery as opposed to several hours to charge one is far more practical.