I wouldn't call the USA a nation of ignorant fools. That's arrogance on your part.Thats just a utopian pipe dream though isn't it? The closest we ever had to this was DB pensions, which it turned out the country couldn't afford.

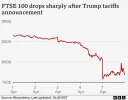

The stock market works, sure it ebbs and flows, and most people are relatively comfortable with that. It works that is until some moron backed by a nation of ignorant idiots interferes so badly that it suddenly doesn't.

Covid caused a dip, quite a serious one, but it was clear and obvious that it had a limited life, and that recovery would follow. With this idiot and his scattergun weaponised tariffs, there isn't a shelf life, it goes on until it doesn't, and even when it doesn't whilst shitgibbon and his supporters are in charge, it might come back again.

It's this uncertainty that has people panicking, not the fact that the FTSE or the Nikkei or whatever has dropped a few points (ok quite a lot of points), the issue is there is no end in sight

Germany likes to have a stable financial system. (Or did)

Traditional interest rates were about ~4% with low inflation. Certainly i can remember interst rates always being higher than the inflation rate when i was much younger. It paid to save. The stock shills might like parabolic growth curves but they are disaster for everyone else.