Kompany Car

Well-Known Member

- Joined

- 19 Sep 2015

- Messages

- 4,290

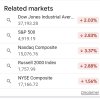

I agree with what i think you are saying in principle that the market prices will lead the actual recovery and you will see an increase before any actual economic recovery. The duration of a bear market by definition is the time taken from the peak to the lowest point and then back to a new all time high.A bear market and recession are not coincident. Often, the largest gains can be made from the bottom of the recession (middle of the Bear Market) to its exit.

Money looks forward 6-9-12 months ahead, so even by your own 15 month recession, in which people like Larry Fink believe we are already mired, we should be seeing a rebound in the near future.

In short, for anyone not needing their money in the next year to two years max, the U.S. Stock Market is on sale. The only question is whether the “retailer” is going to provide further markdowns for tomorrows buyer?!

I guess it depends on your investments as to how you view it, for some they will be drawing down on their portfolios rather than continuing to invest. If that's the case you're only really interested when you get back to where you were before it went to shit. For others who can still buy on the climb back up then yep you want the low which considering markets fall suddenly and then slowly recover that may only be a few months into a bear market.

One thing to consider is that if Trump suddenly starts striking deals the recovery might be a lot sharper than with a tradition bear market. But unless you know the mind of Trump its very difficult to predict.

Last edited: