Betterdeedthan red

Well-Known Member

Again this week's game.There a reason they played on Monday.

And it has nothing to do with fixture congestion.

Monday night.

Next week Sunday .

Again this week's game.There a reason they played on Monday.

And it has nothing to do with fixture congestion.

Full article:

First quarter revenues have fallen at Premier League club Manchester United, while a Q1 profit last year has become a loss in the latest accounts, to September 30, 2025.

However, the club reiterates its full year revenue guidance of £640m to £660m and adjusted EBITDA guidance of £180m to £200m.

Total revenues in the three month period were £140.345m, down from £143.065m, while a £1.628m pre-tax profit the previous year has been transformed into an £8.455m pre-tax loss.

Chief executive, Omar Berrada, said: “These robust financial results reflect the resilience of Manchester United as we make strong progress in our transformation of the club.

“The difficult decisions we have made in the past year have resulted in a sustainably lower cost base and a more streamlined, effective organisation equipped to drive the club towards improved sporting and commercial performance over the long term.

“That has helped us to invest in our men’s and women’s teams, sitting in sixth and third places in the Premier League and Women’s Super League respectively.”

Non-current borrowings have remained the same, at $650m.

Commercial revenue for the quarter was £84.2m, a decrease of £1.1m over the prior year quarter.

Within this, sponsorship revenue was £47m, a decrease of £4.8m due to changes in the commercial partner mix.

Retail, Merchandising, Apparel and Product Licensing revenue rose, however, by £3.7m to £37.2m due to the impact of a full three months’ trading under the club’s new e-commerce model, compared with only one month in the prior year quarter.

Broadcasting revenue for the quarter was £29.9m, a decrease of £1.4m, primarily due to the men’s first team participating in the UEFA Europa League in the prior year quarter, with no UEFA competition in the current year quarter.

Matchday revenue was £26.2m, a decrease of £300,000.

During the course of the past year the club has undertaken a series of staff and expense cuts, which have materialised in lower expenses.

Total operating expenses for the first quarter were £172.4m, a decrease of £13.2m.

This included a £6.6m reduction in employee benefit expenses, ie, wages, which were £73.6m, mainly due to the impact of headcount reduction programmes.

The club incurred no exceptional items this quarter, whereas, in the previous year, they amounted to £8.6m, which comprised costs incurred in relation to the restructuring of the group’s operations, including the redundancy scheme implemented in the first quarter of financial year 2025.

Profit on disposal of intangible assets for the quarter was £45m, an increase of £9.4m on the prior year quarter.

However, net finance costs for the quarter were £21.4m, compared with net finance income of £8.6m in the prior year quarter.

This is primarily due to an unfavourable swing in foreign exchange rates resulting in unrealised foreign exchange losses on unhedged US Dollar borrowings, compared with a favorable swing in the prior year quarter.

In addition to the club’s non-current borrowings of $650m, the group maintains a revolving credit facility which varies based on seasonal flow of funds.

Current borrowings, inclusive of accrued interest, at September 30, 2025 were £268m compared with £232.3m in 2024.

As of first quarter end, cash and cash equivalents were £80.5m compared with £149.6m at the prior year quarter.

Full article:

First quarter revenues have fallen at Premier League club Manchester United, while a Q1 profit last year has become a loss in the latest accounts, to September 30, 2025.

However, the club reiterates its full year revenue guidance of £640m to £660m and adjusted EBITDA guidance of £180m to £200m.

Total revenues in the three month period were £140.345m, down from £143.065m, while a £1.628m pre-tax profit the previous year has been transformed into an £8.455m pre-tax loss.

Chief executive, Omar Berrada, said: “These robust financial results reflect the resilience of Manchester United as we make strong progress in our transformation of the club.

“The difficult decisions we have made in the past year have resulted in a sustainably lower cost base and a more streamlined, effective organisation equipped to drive the club towards improved sporting and commercial performance over the long term.

“That has helped us to invest in our men’s and women’s teams, sitting in sixth and third places in the Premier League and Women’s Super League respectively.”

Non-current borrowings have remained the same, at $650m.

Commercial revenue for the quarter was £84.2m, a decrease of £1.1m over the prior year quarter.

Within this, sponsorship revenue was £47m, a decrease of £4.8m due to changes in the commercial partner mix.

Retail, Merchandising, Apparel and Product Licensing revenue rose, however, by £3.7m to £37.2m due to the impact of a full three months’ trading under the club’s new e-commerce model, compared with only one month in the prior year quarter.

Broadcasting revenue for the quarter was £29.9m, a decrease of £1.4m, primarily due to the men’s first team participating in the UEFA Europa League in the prior year quarter, with no UEFA competition in the current year quarter.

Matchday revenue was £26.2m, a decrease of £300,000.

During the course of the past year the club has undertaken a series of staff and expense cuts, which have materialised in lower expenses.

Total operating expenses for the first quarter were £172.4m, a decrease of £13.2m.

This included a £6.6m reduction in employee benefit expenses, ie, wages, which were £73.6m, mainly due to the impact of headcount reduction programmes.

The club incurred no exceptional items this quarter, whereas, in the previous year, they amounted to £8.6m, which comprised costs incurred in relation to the restructuring of the group’s operations, including the redundancy scheme implemented in the first quarter of financial year 2025.

Profit on disposal of intangible assets for the quarter was £45m, an increase of £9.4m on the prior year quarter.

However, net finance costs for the quarter were £21.4m, compared with net finance income of £8.6m in the prior year quarter.

This is primarily due to an unfavourable swing in foreign exchange rates resulting in unrealised foreign exchange losses on unhedged US Dollar borrowings, compared with a favorable swing in the prior year quarter.

In addition to the club’s non-current borrowings of $650m, the group maintains a revolving credit facility which varies based on seasonal flow of funds.

Current borrowings, inclusive of accrued interest, at September 30, 2025 were £268m compared with £232.3m in 2024.

As of first quarter end, cash and cash equivalents were £80.5m compared with £149.6m at the prior year quarter.

Thank God for Rock of Gibraltar and the piss cans greed without whom they wouldn't be in the shite Amen.Full article:

First quarter revenues have fallen at Premier League club Manchester United, while a Q1 profit last year has become a loss in the latest accounts, to September 30, 2025.

However, the club reiterates its full year revenue guidance of £640m to £660m and adjusted EBITDA guidance of £180m to £200m.

Total revenues in the three month period were £140.345m, down from £143.065m, while a £1.628m pre-tax profit the previous year has been transformed into an £8.455m pre-tax loss.

Chief executive, Omar Berrada, said: “These robust financial results reflect the resilience of Manchester United as we make strong progress in our transformation of the club.

“The difficult decisions we have made in the past year have resulted in a sustainably lower cost base and a more streamlined, effective organisation equipped to drive the club towards improved sporting and commercial performance over the long term.

“That has helped us to invest in our men’s and women’s teams, sitting in sixth and third places in the Premier League and Women’s Super League respectively.”

Non-current borrowings have remained the same, at $650m.

Commercial revenue for the quarter was £84.2m, a decrease of £1.1m over the prior year quarter.

Within this, sponsorship revenue was £47m, a decrease of £4.8m due to changes in the commercial partner mix.

Retail, Merchandising, Apparel and Product Licensing revenue rose, however, by £3.7m to £37.2m due to the impact of a full three months’ trading under the club’s new e-commerce model, compared with only one month in the prior year quarter.

Broadcasting revenue for the quarter was £29.9m, a decrease of £1.4m, primarily due to the men’s first team participating in the UEFA Europa League in the prior year quarter, with no UEFA competition in the current year quarter.

Matchday revenue was £26.2m, a decrease of £300,000.

During the course of the past year the club has undertaken a series of staff and expense cuts, which

Amazing that something as serious as this wasnt made public at the time. Attacking his then teenage girlfriend's family home and it wasnt reported for over 20 years.Oh look - its the BBC daily rags story

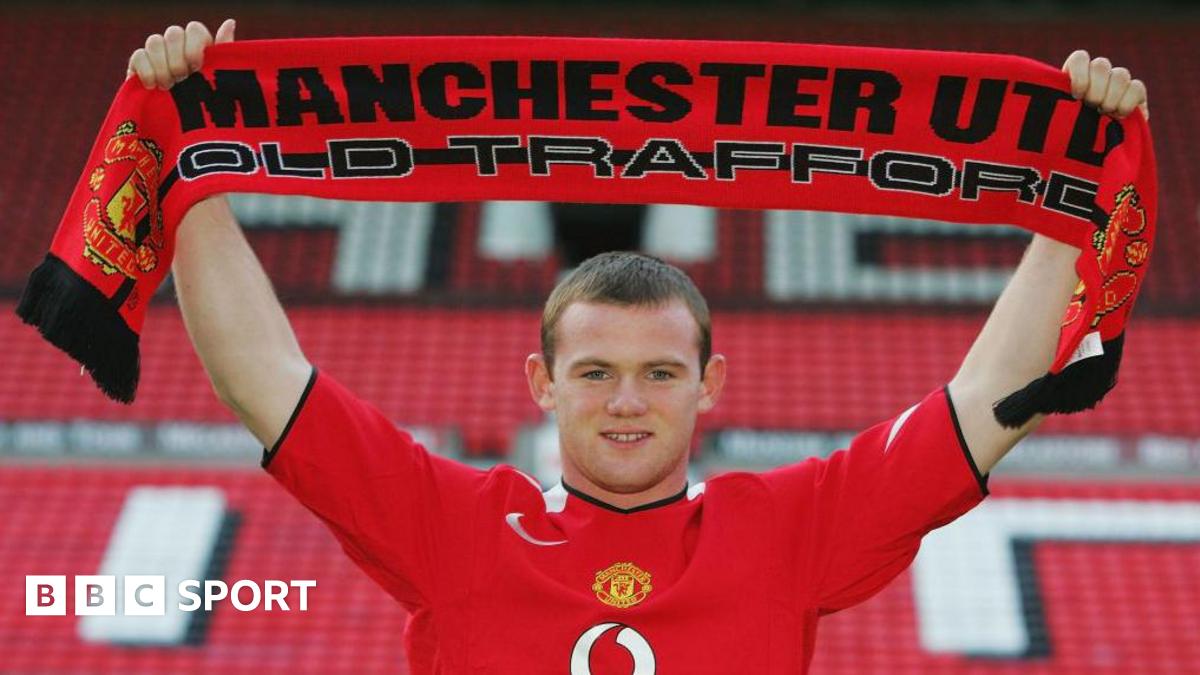

Wayne Rooney says he got death threats when he left Everton for Manchester United.

Former England striker Wayne Rooney says he received death threats when he made the move from boyhood club Everton to Manchester United in 2004.www.bbc.co.uk

They always seem to get by though don't they, tosspots.To a thicko like me it seems to be getting worst for them.

Headline and Berraada says the opposite.

Amazing that something as serious as this wasnt made public at the time. Attacking his then teenage girlfriend's family home and it wasnt reported for over 20 years.

And they only need to look out of the windows at media city to see the rusting leaky roof at the swamp.I think it shows a big money signing to do a BBC podcast isn't going as well as hoped. Its trailed all over 5 Live but I do wonder if its not the success they hoped for. Or perhaps it could be just their obsession with the granny shagger - I mean how many times do you see in promotional video for MotD or if they are carrying a rags game live in the FA Cup you always get a clip of an overhead kick from 15 years ago - you know the one - they even promote their current coverage featuring a teenaged Ronaldo in a rag shirt. The BBC heirarchy cannot acknowledge a decade of demise at the swamp

merseyside police still looking into itAmazing that something as serious as this wasnt made public at the time. Attacking his then teenage girlfriend's family home and it wasnt reported for over 20 years.

Nice one, what an incompetent bunch they are.merseyside police still looking into it

He wrote to Duncan Ferguson!Oh look - its the BBC daily rags story

Wayne Rooney says he got death threats when he left Everton for Manchester United.

Former England striker Wayne Rooney says he received death threats when he made the move from boyhood club Everton to Manchester United in 2004.www.bbc.co.uk

Maybe it was - this is the miseryside cunstabulary we're talking about - Inspector Clouseau has a better track recordAmazing that something as serious as this wasnt made public at the time. Attacking his then teenage girlfriend's family home and it wasnt reported for over 20 years.

The only premier league game live on tv. It’s financial doping. They don’t have to play in Europe to get financial assistance when they get Friday night or Monday night football instead of 3 o’clock matches.Again this week's game.

Monday night.

Next week Sunday .

Certainly looks dodgy.The only premier league game live on tv. It’s financial doping. They don’t have to play in Europe to get financial assistance when they get Friday night or Monday night football instead of 3 o’clock matches.

I read that as Bile Spills Up!

Slightly different to the BBC finance article which heavily quoted Omar Barradi Aka Chemical Ali.