Your first graph shows a big trump bump after he won the election, I know you were 17% up in 4 months, but 8% growth in 5 months aint bad, and it doesn't do much good checking every day, as they design them to put of day traders and panickers normally e.g. if you instruct them to sell at 4pm today you get the price at 11pm tomorrow.Johnny.

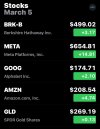

Another graph showing how well the 'North America America' FP fund was doing until Donald started declaring trade wars, etc.

View attachment 148717

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Your first graph shows a big trump bump after he won the election, I know you were 17% up in 4 months, but 8% growth in 5 months aint bad, and it doesn't do much good checking every day, as they design them to put of day traders and panickers normally e.g. if you instruct them to sell at 4pm today you get the price at 11pm tomorrow.

Defo that.

The North America fund was going up and doing well, then Trump winning the election gave it another boost. The adage is, if the North American economy is doing well, so is the world's economy. Obviously that isn't always true. When North America started dropping I didn't act fast enough by getting out. I stayed in hoping for an upturn in the fund.

With Aviva it's before 5pm, at the unit price, then 24 hours to change funds. In that subsequent 24 hours I lost another £1,800. Ouch!

Last edited:

ChicagoBlue

Well-Known Member

- Joined

- 10 Jan 2009

- Messages

- 21,983

Doesn’t the equity portion of your pensions sit in a brokerage account with instant trading?Defo that.

The North America fund was going up and doing well, then Trump winning the election gave it another boost. The adage is, if the North American economy is doing well, so is the world's economy. Obviously that isn't always true. When North America started dropping I didn't act fast enough by getting out. I stayed in hoping for an unturn in the fund.

With Aviva a it's before 5pm, at the unit price, then 24 hours to change funds. In that subsequent 24 hours I lost another £1,800. Ouch!

SWP's back

Well-Known Member

- Joined

- 29 Jun 2009

- Messages

- 90,594

No because it’s a pension trading retail funds rather than a brokerage account. It’s not a day trading account.Doesn’t the equity portion of your pensions sit in a brokerage account with instant trading?

ChicagoBlue

Well-Known Member

- Joined

- 10 Jan 2009

- Messages

- 21,983

I have a significant sum in my Schwab pension fund, which allows me to trade at any time, fee free. I suppose it could be used as a “day trading” account, but there’s still a settle required. They recently changed that to 24 hrs from 3 trading days, but even that allowed an immediate sell & buy, just not a sell, buy, sell.No because it’s a pension trading retail funds rather than a brokerage account. It’s not a day trading account.

I didn’t know pension programs were quite that restrictive in the UK, as such a large money centre.

I honestly don't know.Doesn’t the equity portion of your pensions sit in a brokerage account with instant trading?

I had to tick 3 boxes to come out of all my 3 old funds, and then tick another box to stop future contributions going into my 3 old funds.

I'll speak to Aviva today.

Tommy_Catons_Perm

Well-Known Member

- Joined

- 22 Dec 2011

- Messages

- 2,674

It's time in the market, not timing the market.

Virtually impossible to buy at the lowest point and sell at the highest point.

Virtually impossible to buy at the lowest point and sell at the highest point.

GornikDaze

Well-Known Member

- Joined

- 9 Jul 2012

- Messages

- 10,561

As far as I am aware when switching between retail funds in the UK it depends when the investment provider receives the request. If it is before 12 noon the switch is processed and you will get the next days trading price. If it is after midday you get the prices another day later. I’m sure @SWP's back correct me if I’m wrong, I think he has more current knowledge than me - I’m pleased to be retired ;)I have a significant sum in my Schwab pension fund, which allows me to trade at any time, fee free. I suppose it could be used as a “day trading” account, but there’s still a settle required. They recently changed that to 24 hrs from 3 trading days, but even that allowed an immediate sell & buy, just not a sell, buy, sell.

I didn’t know pension programs were quite that restrictive in the UK, as such a large money centre.

SWP's back

Well-Known Member

- Joined

- 29 Jun 2009

- Messages

- 90,594

That sounds about right and it’s why trying to time the market by checking prices every day is a fool’s errand.As far as I am aware when switching between retail funds in the UK it depends when the investment provider receives the request. If it is before 12 noon the switch is processed and you will get the next days trading price. If it is after midday you get the prices another day later. I’m sure @SWP's back correct me if I’m wrong, I think he has more current knowledge than me - I’m pleased to be retired ;)

ChicagoBlue

Well-Known Member

- Joined

- 10 Jan 2009

- Messages

- 21,983

While it’s a cute saying, and helps the DCA investor sleep at night, it’s not true that you have to buy at the lowest point and sell at the highest, which IS virtually impossible.It's time in the market, not timing the market.

Virtually impossible to buy at the lowest point and sell at the highest point.

BUT

A $100 stock is on its way down to who knows where, but I have a 10% stop loss on it, so it sells at $90.

I don’t have to buy it back at the low of, say $65, to come out ahead, but if I do see it down there, but coming back UP and buy it at $75 or $80, I’ve already made serious money by the time it gets back to my “sell” price of $90, let alone my “buy and hold” $100!

The “mistake” is selling it on the way down at $90 and then buying it back on its way back up ABOVE $90! That’s the time when “buy and hold” has worked for you.

Here’s another cute one for you:

If you don’t buy and hold, and instead like to trade in and out by timing the market, you have be right twice to come out ahead…once when you time the sell, and once when you time the buy!

SWP's back

Well-Known Member

- Joined

- 29 Jun 2009

- Messages

- 90,594

You forget that buying single companies is relatively common in the US but in the UK the pension regulator and FCA has an aneurysm if people try and put 90% of their funds into an equity INDEX (even across 500 companies!) let alone picking individual stocks.While it’s a cute saying, and helps the DCA investor sleep at night, it’s not true that you have to buy at the lowest point and sell at the highest, which IS virtually impossible.

BUT

A $100 stock is on its way down to who knows where, but I have a 10% stop loss on it, so it sells at $90.

I don’t have to buy it back at the low of, say $65, to come out ahead, but if I do see it down there, but coming back UP and buy it at $75 or $80, I’ve already made serious money by the time it gets back to my “sell” price of $90, let alone my “buy and hold” $100!

The “mistake” is selling it on the way down at $90 and then buying it back on its way back up ABOVE $90! That’s the time when “buy and hold” has worked for you.

Here’s another cute one for you:

If you don’t buy and hold, and instead like to trade in and out by timing the market, you have be right twice to come out ahead…once when you time the sell, and once when you time the buy!

As the article I posted a page back shows, missing the ten best days of the S&P500 over the last 30 years halves your return whereas leaving it in gives around 11-13% pa annual return (which most investors would kill for).

What you say above re single shares is entirely correct but stats show that people that do try and time the market are usually several days/weeks late on getting out and months late on getting back in. So for the vast vast vast majority reading this on here, having a well diversified portfolio of mutual funds across different asset classes, geographic locations and industries and holding whilst checking the value every few years or so will be much better.

You’re well read so I’m sure you’re aware Fidelity did a study in 2013 that showed their best performing retail investors were actually dead because they held their stocks and didn’t make emotional decisions and cognitive bias.

Stockton Heath Blue

Well-Known Member

Do you not have an advisor to look after your pension? I wouldn't be able to sleep if I was micro-managing my pension fund like you seem to be doing.Defo that.

The North America fund was going up and doing well, then Trump winning the election gave it another boost. The adage is, if the North American economy is doing well, so is the world's economy. Obviously that isn't always true. When North America started dropping I didn't act fast enough by getting out. I stayed in hoping for an upturn in the fund.

With Aviva it's before 5pm, at the unit price, then 24 hours to change funds. In that subsequent 24 hours I lost another £1,800. Ouch!

Out of interest, how old are you? I've been in the same boat as you recently, where there have been huge swings in my portfolio value. I'm 55 soon, with a target (aspirational) retirement age of 60, but more likely 62-65. I'm hoping pound cost average rules will pay me back as my funds buy cheaper units and the prices then recover to previous levels.

ChicagoBlue

Well-Known Member

- Joined

- 10 Jan 2009

- Messages

- 21,983

Absolutely agree with all, and as a fan of Buffet, I like his advice for the average investor, which mirrors your own.You forget that buying single companies is relatively common in the US but in the UK the pension regulator and FCA has an aneurysm if people try and put 90% of their funds into an equity INDEX (even across 500 companies!) let alone picking individual stocks.

As the article I posted a page back shows, missing the ten best days of the S&P500 over the last 30 years halves your return whereas leaving it in gives around 11-13% pa annual return (which most investors would kill for).

What you say above re single shares is entirely correct but stats show that people that do try and time the market are usually several days/weeks late on getting out and months late on getting back in. So for the vast vast vast majority reading this on here, having a well diversified portfolio of mutual funds across different asset classes, geographic locations and industries and holding whilst checking the value every few years or so will be much better.

You’re well read so I’m sure you’re aware Fidelity did a study in 2013 that showed their best performing retail investors were actually dead because they held their stocks and didn’t make emotional decisions and cognitive bias.

I’m sorry I missed your article and will go back and take a look.

Dollar Cost Averaging (not sure what they call it elsewhere?) is an excellent tool for the average investor, and a broad based index fund is an excellent place to use that tool.

Personally, I use a mix of funds and individual stocks, esp if you include Berkshire Hathaway as a proxy for a broad based US fund!

I also have a not insignificant weighting of “cash” in money fund currently returning about 4.2% (SWVXX).

Given the current cash holdings of BRKB, I feel like there’s a reasonable amount of cash to be put to use, as needed, at a moments notice, either by myself or Buffet and Abel.

(P.S. I’m 61.3 yrs old, have to retire in 3.7 yrs, and have two annuities that will cover my basic living costs. The equities above are my inflation hedge on those annuities, one of which even has a COLA attached, and the “not just living, but enjoying, life” money. I will be debt-free. I only state this to avoid the “that’s a risky looking portfolio for someone so close to retirement” comments. I plan to stay invested pretty much as is, consistently increasing those monies on a monthly basis, albeit with a decrease in my Money Fund {It’s larger than normal at present, due mainly to Trump & Geopolitics} as and when I’m comfortable putting it back into the risk category)

Last edited:

Do you not have an advisor to look after your pension? I wouldn't be able to sleep if I was micro-managing my pension fund like you seem to be doing.

Out of interest, how old are you? I've been in the same boat as you recently, where there have been huge swings in my portfolio value. I'm 55 soon, with a target (aspirational) retirement age of 60, but more likely 62-65. I'm hoping pound cost average rules will pay me back as my funds buy cheaper units and the prices then recover to previous levels.

I'm 57.

TBH I haven't taken a lot of interest in my pension since I started working. I'm an idiot. Full stop. Too late now. I've been in and out of my pension all my life. Putting in the maximum, and then the minimum. Etc. I've only started taking an interest in my pension in the last year. Mad, isn't it.

I'm resigned to hopefully getting my pension pot to x over the next 10 years before I retire. That will have to do me, plus my state pension, plus the equity from my house when I downsize in the future. I won't ever be pension rich. I might be comfortable. I won't struggle financially in my latter years. I might die tomorrow? Hopefully not. :-)

Just a quick update on my 3 new funds. In the last 24 hours I'm down about £280. Which is much better than my previous 3 funds where I was down £1000's in a day. As shares keep on falling because of Trump, I can at least stomach losses of £100's now instead of £1000's. Hopefully the bounce back in share prices across pension funds will come sooner rather than later?

Any plain and simple advice would be welcomed. I've still got 10 years before I retire, so I can still make some money towards my pension and retirement. Thanks.

Last edited:

ChicagoBlue

Well-Known Member

- Joined

- 10 Jan 2009

- Messages

- 21,983

The other side of that coin, of course, is where would you be if you missed the 10 WORST days of the S&P 500 over the last 30 years?As the article I posted a page back shows, missing the ten best days of the S&P500 over the last 30 years halves your return whereas leaving it in gives around 11-13% pa annual return (which most investors would kill for).

Answer: Over the last 30 years, the average annual return of the S&P 500 was approximately 10.4% using a buy-and-hold strategy. If you successfully avoided the 10 worst days, your annualized return would have increased to about 13.2%, significantly outperforming the average return.

That’s over a 25% INCREASE in your return!!

The trick, of course, is avoiding them! ;-)

chris85mcfc

Well-Known Member

- Joined

- 28 Jun 2013

- Messages

- 7,021

Time in the market > Timing the market

Time in the market > Timing the market

If everyone got that right, we'd all be rich. :-)

The thing is, stock brokers have brought banks down on their own.

Nicholas William Leeson (born 25 February 1967) is an English former derivatives trader whose fraudulent, unauthorised and specultive trades resulted in the 1995 collapse of Barings Bank, the United Kingdom's oldest existing merchant bank.

ChicagoBlue

Well-Known Member

- Joined

- 10 Jan 2009

- Messages

- 21,983

If you want “average” returns, and I’m not knocking that concept.Time in the market > Timing the market

Charlie Munger believes that he doesn’t want the top 500 companies in his portfolio, but maybe the best 5-10 of those. He seems to have done alright for himself, pretty much doubling “average” over time.

Recently, that’s been classed as “The Magnificent Seven” by most people.

chris85mcfc

Well-Known Member

- Joined

- 28 Jun 2013

- Messages

- 7,021

Yeah and then went onto do a load of time in prison!If everyone got that right, we'd all be rich. :-)

The thing is, stock brokers have brought banks down on their own.

Nicholas William Leeson (born 25 February 1967) is an English former derivatives trader whose fraudulent, unauthorised and specultive trades resulted in the 1995 collapse of Barings Bank, the United Kingdom's oldest existing merchant bank.

chris85mcfc

Well-Known Member

- Joined

- 28 Jun 2013

- Messages

- 7,021

Munger and Buffet were both massive encourages of taking advantage of long term compounding, which will see you with ridiculous returns if you start investing early in lifeIf you want “average” returns, and I’m not knocking that concept.

Charlie Munger believes that he doesn’t want the top 500 companies in his portfolio, but maybe the best 5-10 of those. He seems to have done alright for himself, pretty much doubling “average” over time.

Recently, that’s been classed as “The Magnificent Seven” by most people.

You'd have to be monitoring your portfolio almost as your full time job in order to get significantly greater than average returns

I doubt the vast majority of people on here fall into that category!