Gareth Barry Conlon

Well-Known Member

- Joined

- 5 Sep 2014

- Messages

- 14,658

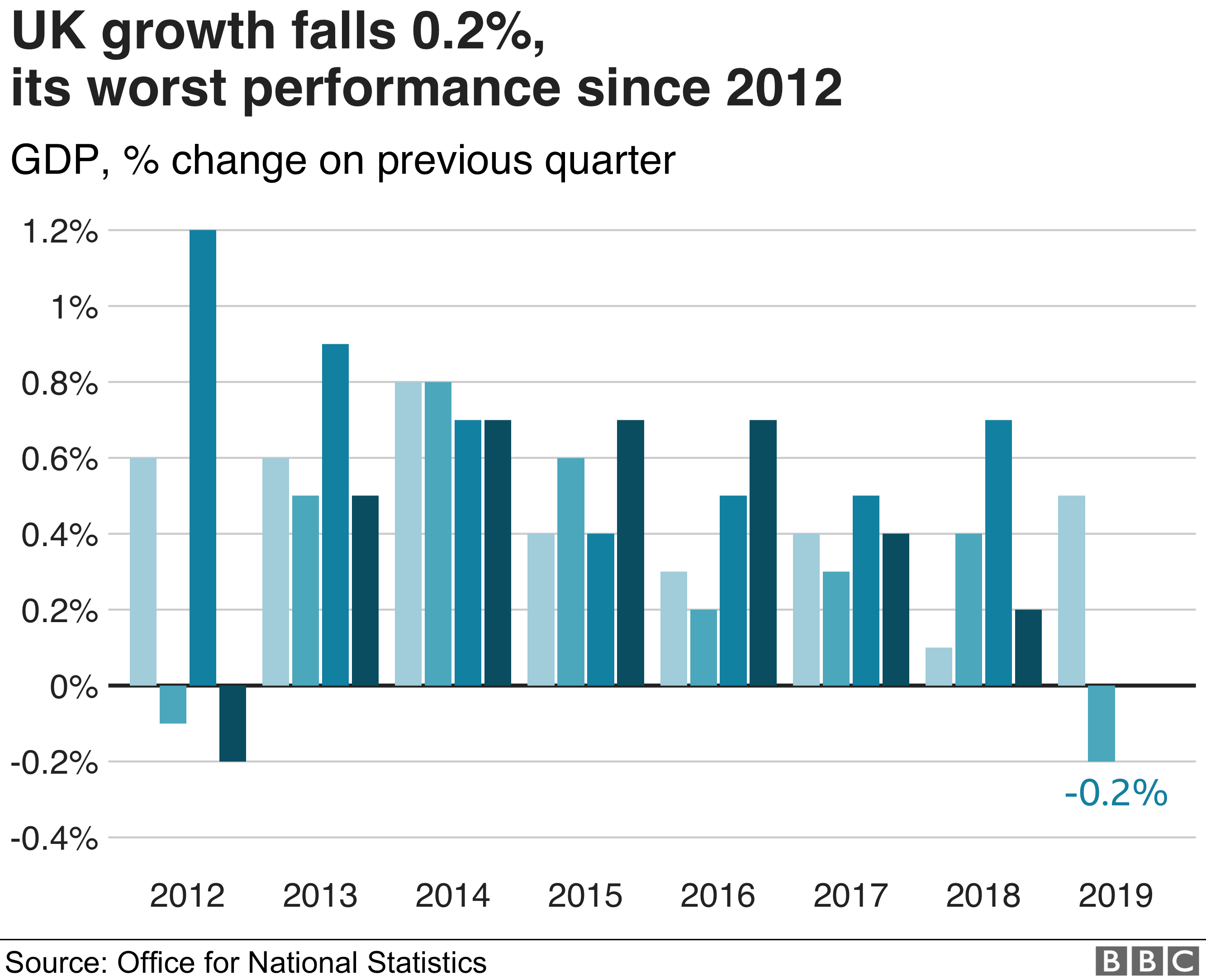

As a bit of an armchair economist I have been seeing signs of an impending recession for a couple of years, but we and the rest of the world seem to be bouncing along pretty well, jobs numbers are very high globbaly and therefore GDP growth is tracking moderatley upward in most countries.

But you look at the more subtle financial indicators and they are all showing some pretty alarming trends. Interest rates are low yet investment returns are also low, Banks can't make money in that environment - when they cant make money they tend to reign things in as the returns are not worth the risk. Barclays have just anounced an 80% drop in profits. The chairman saying:-

We acknowledge that the outlook for next year is unquestionably more challenging now than it appeared a year ago, in particular given the uncertainty around the UK economy and the interest rate environment,”.

If you subscribe to the idea that these things always move in cycles then we had the dot com crash of 2000/2001, the credit crunch of 2007/8/9 (although you could argue that went on for 5 years or more) and we are now circa 10 years beyond that. Next year could well be tough.

But you look at the more subtle financial indicators and they are all showing some pretty alarming trends. Interest rates are low yet investment returns are also low, Banks can't make money in that environment - when they cant make money they tend to reign things in as the returns are not worth the risk. Barclays have just anounced an 80% drop in profits. The chairman saying:-

We acknowledge that the outlook for next year is unquestionably more challenging now than it appeared a year ago, in particular given the uncertainty around the UK economy and the interest rate environment,”.

If you subscribe to the idea that these things always move in cycles then we had the dot com crash of 2000/2001, the credit crunch of 2007/8/9 (although you could argue that went on for 5 years or more) and we are now circa 10 years beyond that. Next year could well be tough.