gouldybob

Well-Known Member

Better that than your tits going down to your kneesOnce the seats in front of the bloke go in my knees would be up on my tits.

Better that than your tits going down to your kneesOnce the seats in front of the bloke go in my knees would be up on my tits.

I'm in the process of meeting them half way ; )Better that than your tits going down to your knees

Make a great Christmas cardstunning picture that!

138506/FO/2023|Erection of bronze statue with concrete plinth.

138506/FO/2023|Erection of bronze statue with concrete plinth.So in Bronze ? Should look incredible going off the artist whose done them.New statue of the 3 legends to be unveiled next Tuesday

Artist has also been revealed now too.New statue of the 3 legends to be unveiled next Tuesday

The Gail Platt standBetter that than your tits going down to your knees

That’s the final look.

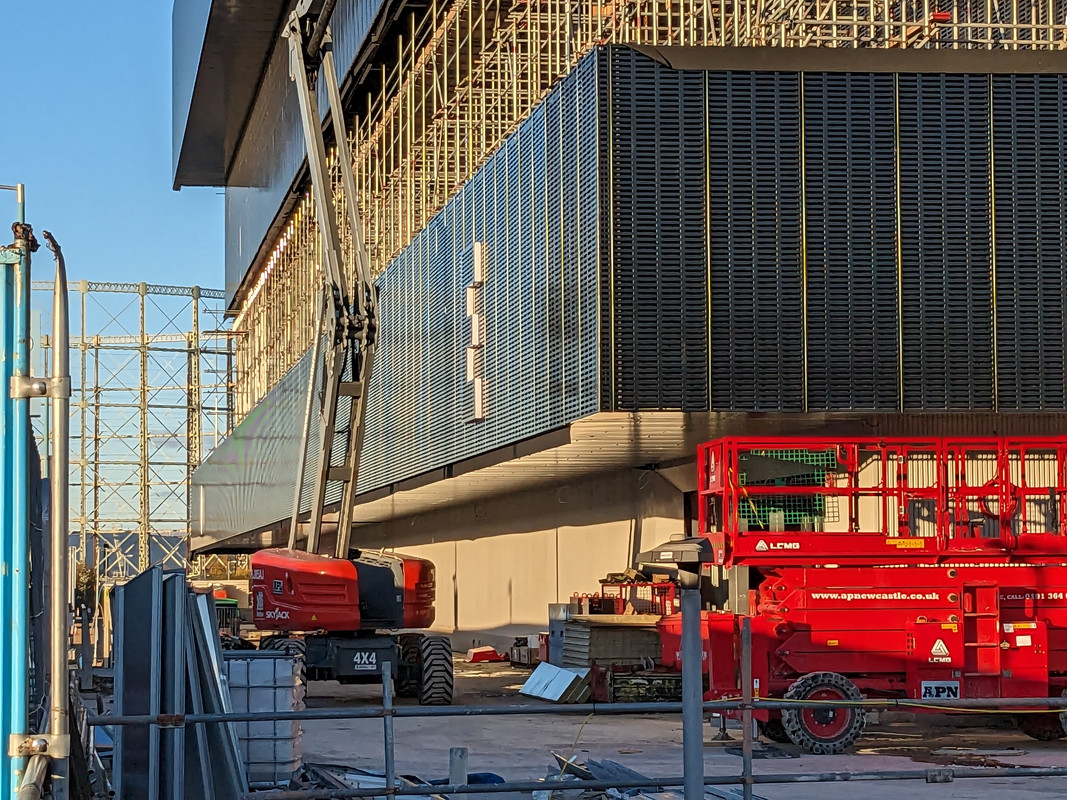

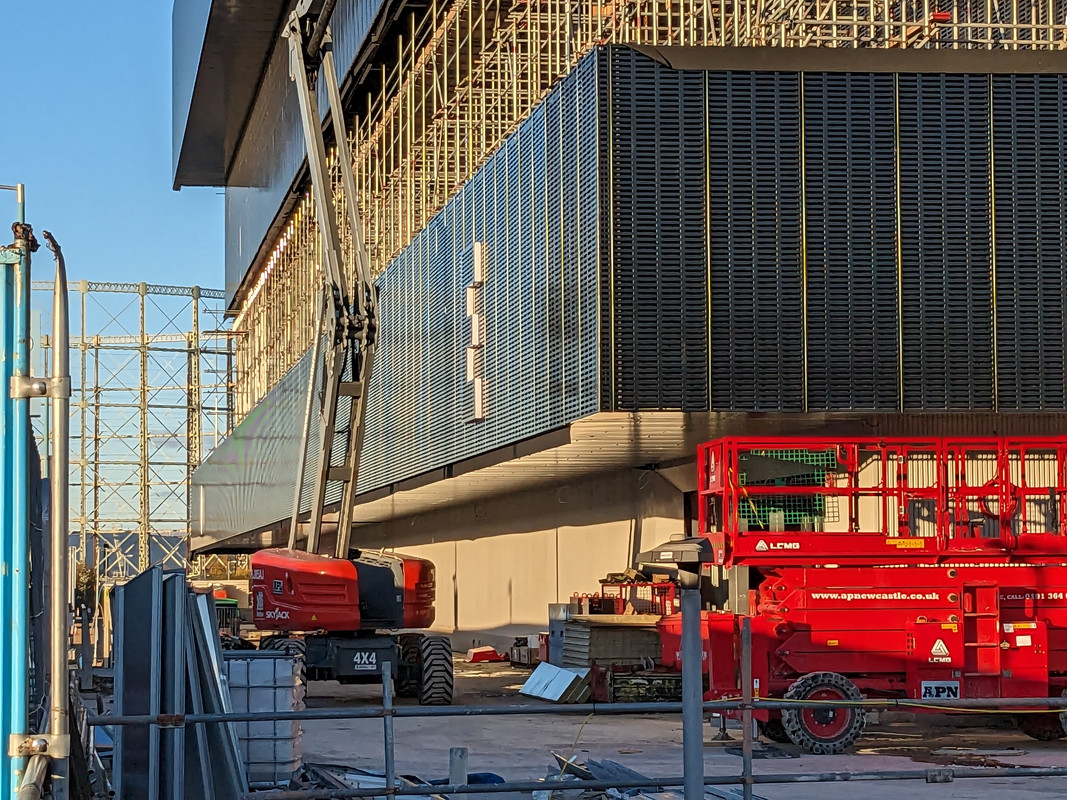

See my previous post on Fire Marshalls a while back. Gigs will be on but there will still be work going on until next seasonThis afternoon.

I asked the question.

"Is it still on schedule?"

The reply.

"Which one?"

"It's been a nightmare from day one"

Looking at the arena externally, it seems to be all over the place. Not one of the 4 sides is finished, and there are bits of work to do on all 4 sides, as well as larger and more obvious work to do. The work looks a bit mish-mash externally.