FanchesterCity

Well-Known Member

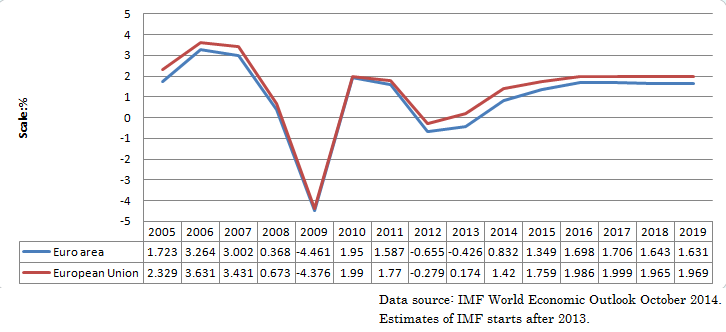

That makes the decline in eu activity even more puzzling surely logic would tell you that there should be some correlation in the increase in Chinese activity and growth with an increase in European activity?

In answer to your question, it is wholly down to the austerity measures implemented by the eu

( read Germany) since 2010. Countries have had to internally devalue ( they have no currency to devalue) by taking wage cuts, jobs have been decimated, less public spending, banks restructuring their capital buffers in the eu and restricting lending for investments, bail outs and that's because they do not have the ability to treat individual errors separately because of the currency.

Depends what they produced and how much was exported and to whom.

They may well have an increased GDP as a result of domestic products.

Their 'growth' could and probably is largely internal, and there could be a lag between that growth and the rest of the world feeling the effects of it as they start to trade more.

So, for simplicities sake, they could spend billions producing beach ball making machines - which would show up on their GDP, and not do any exports. Then next period, they start making beachballs, also showing up on their GDP, and then export them - which THEN starts showing as correlating activity on Europe (or wherever they flog beachballs too)

Last edited: