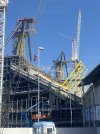

Hope you brought plenty of spare batteries with you to capture all the to-ing and fro-ingAnd now it’s back on the ground!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

North Stand Construction Discussion

- Thread starter awest

- Start date

Pablo ZZZ Peroni

Well-Known Member

- Joined

- 19 May 2014

- Messages

- 2,671

From the UEFA Club Licensing and Financial Fair Play Regulations, version released on 1 June 2018 (which is the latest version I get from UEFA's website).

Annex X details what does and doesn't count as income, and by virtue of Section A, paras f) and l), income from "non-football operations not related to the club" are excluded but those related to the club are permissible.

As to what this means, the following is from para l) of Section B of Annex X of the Regulations:

My understanding has always been that rent from facilities located on land around the stadium owned by the MCFC JV with the City Council, including the collar site in the fullness of time but also Co-op Live, can be included by virtue of the first bullet above. Happy to be shown to be wrong if I am.

FYI, I posted this in reply to someone in 2021 based on an article in the FT in September 2020.

"I've checked my original source which was a detailed article in the FT last September.

According to the FT article the land is actually owned by a JV between ADUG (80%) and MCC (20%). So I should have said ADUG own the land with MCC. However, the article goes on to say Oak View will pay an annual lease payment worth millions of pounds to CFG which presumably will be allocated to MCFC - ( ADUG>CFG>MCFC).

The 50/50 JV for the build is CFG and Oak View so, yes, highly likely 50/50 on profits for CFG>MCFC and Oak View. I understand what you are saying about infastructure costs but personally not 100% certain we qualify."

Basically, you are advancing my uncertainty from back then :) It would be good to know...

Last edited:

F

F

failsworthblueboy

Guest

F

F

failsworthblueboy

Guest

F

F

failsworthblueboy

Guest

They probably took the left handed one up and not the correct right handed one.

Gray

Well-Known Member

- Joined

- 30 May 2004

- Messages

- 28,988

- Team supported

- ABU & The Bus Wreckers

Why would they go to all that trouble if they were never going to fit it?If it is that, it would be up to the contractors to absorb the costs, but it could mean a delay. That said, their may be a work around, of the rivets don’t line up exactly we have already seen them overcome slight misalignments.

Or, possibly the lift was a rehearsal

Gray

Well-Known Member

- Joined

- 30 May 2004

- Messages

- 28,988

- Team supported

- ABU & The Bus Wreckers

Gray

Well-Known Member

- Joined

- 30 May 2004

- Messages

- 28,988

- Team supported

- ABU & The Bus Wreckers

Just look at the sky in those photos, Gods own colour.

FYI, I posted this in reply to someone in 2021 based on an article in the FT in September 2020.

"I've checked my original source which was a detailed article in the FT last September.

According to the FT article the land is actually owned by a JV between ADUG (80%) and MCC (20%). So I should have said ADUG own the land with MCC. However, the article goes on to say Oak View will pay an annual lease payment worth millions of pounds to CFG which presumably will be allocated to MCFC - ( ADUG>CFG>MCFC).

The 50/50 JV for the build is CFG and Oak View so, yes, highly likely 50/50 on profits for CFG>MCFC and Oak View. I understand what you are saying about infrastructure costs but personally not 100% certain we qualify."

Basically, you are advancing my uncertainty from back then :) It would be good to know...

And you've made me doubt much more than I previously did. Is it from the FT that you took the fact it's ADUG involved in the JV? I know it's ADUG involved in the Manchester Life partnership, but the Council's official documents back in the day suggested specifically that the JV to develop land on and around the Campus would be entered into with MCFC.

That to me makes a difference. If rent is paid to a company that's an 80% subsidiary of MCFC, then that's activity basically being carried out by MCFC. Thus it potentially qualifies for an FFP exemption subject to that close proximity condition that we discussed an how it's interpreted. An ADUG company receiving rent is a sister company of MCFC, which doesn't have a direct link so isn't MCFC activity at all, just as Manchester Life isn't.

In any case, the FT apparently says that CFG will receive a rental payment. How? Has the lad been transferred to CFG for it to pursue a venture on its own with OVG and thus receive the rent in return for its investment in the venture?

Given that the Arena is a JV between CFG and OVG, I could see CFG having procured loan financing from ADUG which is to be repaid out of profits over the first few years as a first priority after third-party bank loans are serviced. But if CFG is taking the rent, surely that suggests the whole thing has been structured so that revenues don't go to MCFC?

Might be worth an FoI request if anyone can be bothered. I'd always assumed that the development of the Campus was to allow funds to flow into MCFC to sustain a top European football club, but maybe the idea is for the funds to sustain CFG as a whole.

Penders1957

Well-Known Member

- Joined

- 14 Jul 2024

- Messages

- 469

- Team supported

- Man city

Sorry but what makes you think they are handed ??They probably took the left handed one up and not the correct right handed one.

Centurions

Well-Known Member

It's to do with the tension on the cables, one has to be a right handed thread, the other a left handed thread.Sorry but what makes you think they are handed ??

Correct, and of course which side of equator comes into play too.It's to do with the tension on the cables, one has to be a right handed thread, the other a left handed thread.

Bournemouth Blue

Well-Known Member

- Joined

- 21 Mar 2015

- Messages

- 3,430

That will be at Old Trafford, beneath the highest waterfall in EnglandWhere's the swimming pool going?

Those diving boards are pretty high up.

remember arthur mann

Well-Known Member

And you've made me doubt much more than I previously did. Is it from the FT that you took the fact it's ADUG involved in the JV? I know it's ADUG involved in the Manchester Life partnership, but the Council's official documents back in the day suggested specifically that the JV to develop land on and around the Campus would be entered into with MCFC.

That to me makes a difference. If rent is paid to a company that's an 80% subsidiary of MCFC, then that's activity basically being carried out by MCFC. Thus it potentially qualifies for an FFP exemption subject to that close proximity condition that we discussed an how it's interpreted. An ADUG company receiving rent is a sister company of MCFC, which doesn't have a direct link so isn't MCFC activity at all, just as Manchester Life isn't.

In any case, the FT apparently says that CFG will receive a rental payment. How? Has the lad been transferred to CFG for it to pursue a venture on its own with OVG and thus receive the rent in return for its investment in the venture?

Given that the Arena is a JV between CFG and OVG, I could see CFG having procured loan financing from ADUG which is to be repaid out of profits over the first few years as a first priority after third-party bank loans are serviced. But if CFG is taking the rent, surely that suggests the whole thing has been structured so that revenues don't go to MCFC?

Might be worth an FoI request if anyone can be bothered. I'd always assumed that the development of the Campus was to allow funds to flow into MCFC to sustain a top European football club, but maybe the idea is for the funds to sustain CFG as a whole.

CFG made a £112mill loss in 2022/23

Guessing. Any eventual profit from our side of the Coop Live Arena will go towards the CFG and it's running.

City Football Group (CFG) recorded losses of UK£112 million (US$141.9 million) for the 2022/23 financial year despite generating record revenue of UK£877.1 million (US$1.1 billion).

Man City news: City Football Group makes £112m loss in 2022-23 financial year

Man City news: City Football Group makes £112m loss in 2022-23 financial year

CITY FOOTBALL GROUP LIMITED filing history - Find and update company information - GOV.UK

CITY FOOTBALL GROUP LIMITED - Free company information from Companies House including registered office address, filing history, accounts, annual return, officers, charges, business activity

CITY FOOTBALL GROUP LIMITED people - Find and update company information - GOV.UK

CITY FOOTBALL GROUP LIMITED - Free company information from Companies House including registered office address, filing history, accounts, annual return, officers, charges, business activity

Penders1957

Well-Known Member

- Joined

- 14 Jul 2024

- Messages

- 469

- Team supported

- Man city

Sorry but is this a wind upIt's to do with the tension on the cables, one has to be a right handed thread, the other a left handed thread.

blueparrot

Well-Known Member

- Joined

- 7 Jun 2012

- Messages

- 33,597

No, a wind down.Sorry but is this a wind up