Came on holiday on Weds and decided I wasn’t going to have time (or the inclination) to watch the news constantly for the next clusterfuck yo occur, so sold all my stock bar my long term BRKB and dumped the money in a 4.2% money fund (SWVXX).

Dumb luck ;-) and timing won out yet again!

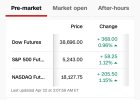

Tuesday’s U.S. stock futures looking for a little rebound, but 3% down and even 1% back up in 2 days is still a bad 2 days!

View attachment 153643

We’ll see what the trading day brings, but earnings season is in full swing and anyone missing the numbers and/or a negative outlook (if they dare give

any outlook!) will not be treated with kid gloves!