P

P

PPT

Guest

I've been banging on about this for a long time and the lefties just will not have it,Funny how the left rarely mention public sector pension contributions. I (in the private sector) am obiged to contribute 5% of my pay so that the company puts in 5% - it used to be 4%.

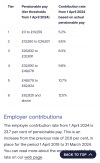

View attachment 132023

This is what the government puts in to civil servants’ pensions. 29% per year of their salary. No wonder they all retire at 50 with £1m+ pension pots. Who on earth manages that in the private sector, other than a few company bosses?

It is a genuine national scandal. And don't forget the pensions are index linked for life.

It's a very unfunny joke.