Ifwecouldjust.......

Well-Known Member

You can start taking your private pension at 55, put plenty in there.

Incorrect ..... they've already passed legislation to move that to 57 ... more to follow

Because ...... Conservatives

You can start taking your private pension at 55, put plenty in there.

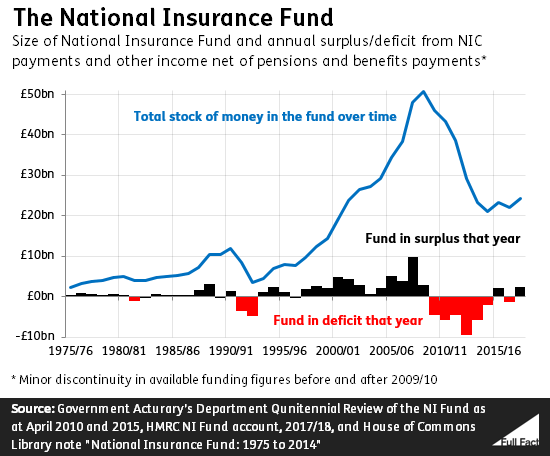

£97bn spent on state pensions in 2018/19, are there any serious alternatives other than deferring retirement age? The government has already legislated to move everyone into a contributory pension scheme, subject to opt-out. Pensions have been a joke for years, as someone already said it's another area to shaft youngsters of today, but there's no alternative.

If you have one, this is the important thing, get hold of it asap, even if it means losing on on a couple of quid short-term by cashing-in early given the opportunity. Took mine as a full one at 51 due to a work package, Mrs Moon (53) taking hers 2 years early next month...worked out she'll be 'in credit' until she's 72.You can start taking your private pension at 55, put plenty in there.

It’s not been built into legislation as of yet to be fair although they have said it would raise to 57 in 2028.Incorrect ..... they've already passed legislation to move that to 57 ... more to follow

Because ...... Conservatives

National debt can only rise whilst country is in deficit. Which should be obvious.despite that the Tories have tripled the national debt since 2010)

Or a stocks and shares port folio, if you gamble and are lucky enough no limit on the age.You can start taking your private pension at 55, put plenty in there.

Not a gamble if investing for the long term (a pension is invested in the exact same anyway, the only difference being the specific tax wrapper)Or a stocks and shares port folio, if you gamble and are lucky enough no limit on the age.

I’ve only a small stock folio but it’s split between blue chip shares, medium risk and high risk. The good thing is when I depart Mrs H cops for the lot whilst my Pension provider halves the pay out.Not a gamble if investing for the long term (a pension is invested in the exact same anyway, the only difference being the specific tax wrapper)